Frequently Asked GCIB Questions

Explore our FAQ section for quick answers to your questions about GCIB’s services, products, and offerings. Here, you’ll find essential information to guide you on your financial journey with us.

What documents are required for me to start my investment portfolio?

The following documents are required to invest

- A filled in individual application form or login to client portal

- A copy of ID or your current passport

- A copy of your KRA PIN

- Proof of bank details: Bank statement not more than 3 months old or, cancelled cheque leaf or, certified letter from the bank confirming bank details, ATM copy

- MPESA payment or deposit slip in the correct Fund

With this, send a confirmation message to clientservices@gcib.africa

How do I sign up on the investment platform

- Head over to our investments portal: portal.gcib.africa

- Select your account type. You can chose between Individual, Corporate, Joint Account or Partnership

- Fill in the registration form for your preferred account type and click next

- You will then be prompted to enter the one time code (OTP) sent to the mobile number provided

- You will then be prompted to create and confirm your account password. Make sure that it is a strong password with a mix of uppercase and lowercase letters, numbers, and symbols

- You will then receive an email on the address provided to verify your account on the provided link

- Once your account is validated, you will be redirected to your personal dashboard where you can create a new investment

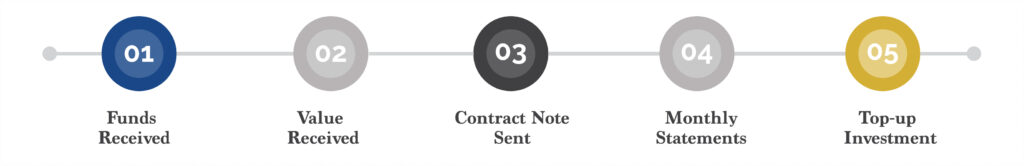

What is the GCIB Investment process?

What is the GCIB redemption process?